vitreus [vee-tree-us], verb:

To Create Transparency

Accurate, compliant, and accessible pre-qualification lock-step with institutional controls.

HOW IT WORKS

STEP 1

Vitreus pulls qualification data from your LOS or POS, and the lender completes setup including borrower, real estate agent, and additional access.

STEP 2

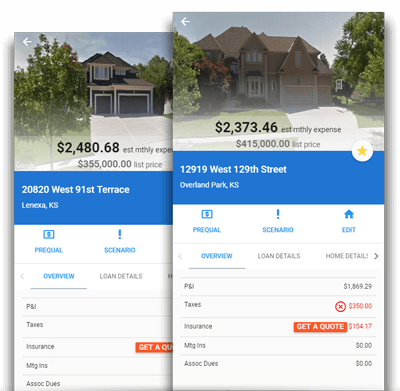

Vitreus provides the borrower with maximum affordability calculations – based on monthly payment, and including area-specific factors, loan program, and the lender’s institutional controls. Affordability is automatically re-calculated in real-time when any of these variables change.

STEP 3

The borrower can browse and compare monthly payments on any home in the United States through the Vitreus platform, giving them the ability to plan their purchase accurately and increase their overall buying power.

STEP 4

Once the borrower finds a home they would like to make an offer on, Vitreus extends the power to generate an official offer letter directly to the borrower and real estate agent… Anytime, anywhere!

STEP 5

Vitreus generates an accurate, compliant, pre-qualification letter that the borrower can afford and the lender can close. Submit an offer on the most appropriate home based on true monthly affordability with confidence!

- The lender is happy to realize efficiencies, preserve their reputation, and convert the deal.

- The borrower's expectations were satisfied, restoring faith in a notoriously opaque experience. Plus - they're moving into their new home that maximized their buying power!

- The real estate agent achieves their commission, plus referrals from a happy customer.

Win. Win. Win.